Have you ever dreamt of driving the car of your dreams but found yourself frustrated by the limitations of traditional car loans? The idea of owning a car might seem out of reach, especially if you have less-than-perfect credit or struggle with consistent income. But what if there was a way to drive the car you desire while simultaneously building your credit and moving towards ownership? This is where a Rent to Own car contract template comes in.

Image: www.examples.com

Rent to Own car contracts, often referred to as lease-to-own, offer a unique alternative to the traditional car buying experience. They allow individuals to rent a vehicle with the option to purchase it later. This arrangement not only provides immediate access to a reliable car but also opens a pathway to ownership without the stringent requirements of a traditional car loan. In this comprehensive guide, we will dive into the intricacies of rent to own car contracts, explore their benefits and drawbacks, and provide essential insights into using a template to craft a secure and transparent agreement.

Understanding the Basics of a Rent to Own Car Contract

At its core, a rent to own car contract is a legally binding agreement between a car owner (the lessor) and a renter (the lessee). It outlines the terms and conditions of renting a vehicle with the ultimate goal of owning it. The agreement typically includes details about monthly payments, rental duration, purchase option, and any associated fees. Unlike traditional car leases, the lessee’s ultimate goal is not to return the car at the end of the term but to purchase it outright.

Key Components of a Rent to Own Car Contract

A well-structured rent to own contract comprises several essential sections to ensure both the lessor and lessee are protected. These key components include:

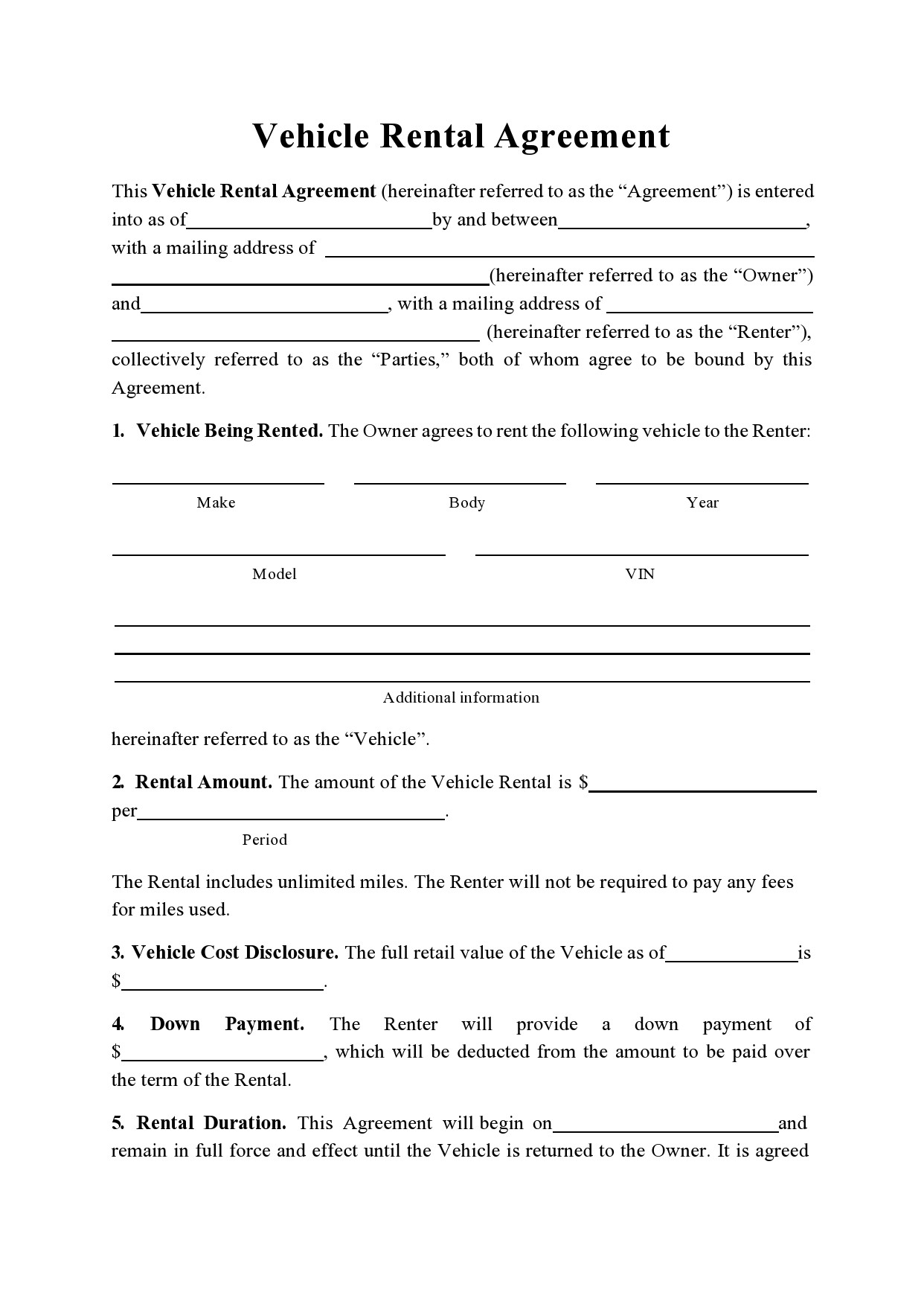

1. Vehicle Information

This section provides detailed information about the car being rented. This includes the make, model, year, VIN (Vehicle Identification Number), mileage, and any existing damage or defects. Detailed information about the car’s condition from the start is crucial for avoiding disputes and establishing clear expectations.

Image: templates.udlvirtual.edu.pe

2. Rental Period and Payments

The rental period defines how long the lessee will rent the car. The contract will also clearly state the monthly rental payments, due date, and any associated late fees. It is essential to understand the payment frequency and ensure you can consistently meet these financial obligations.

3. Purchase Option

This is the heart of the rent to own agreement. It outlines the terms under which the lessee can purchase the vehicle at the end of the rental period. Typically, the purchase price is negotiated upfront and may be a fixed amount or calculated based on a formula incorporating the remaining payments. The contract should also be clear about the ownership transfer process, including required documentation.

4. Maintenance and Repair Responsibilities

The contract should explicitly define the roles of both the lessor and lessee in terms of vehicle maintenance and repair. Typically, the lessee takes on the responsibility of routine maintenance such as oil changes, tire rotations, and regular check-ups. The lessor might be responsible for more significant repairs, depending on the agreement. Clarifying these responsibilities prevents any confusion or conflict down the line.

5. Termination Clause

This section describes the rules governing early termination of the contract. It may specify the conditions under which either party can terminate the lease and the consequences associated with it. For example, it might stipulate the payment of a termination fee or the potential forfeiture of any payments made. Understanding the termination clause allows you to gauge the risks and flexibility associated with the agreement.

6. Default Clause

The default clause details the consequences of the lessee failing to meet the agreed-upon obligations, such as late payments or neglecting maintenance. It may include penalties such as increased fees, suspension of the purchase option, or even repossession of the vehicle. Recognizing the potential consequences of default is vital for understanding the potential financial risks.

Benefits of Using a Rent to Own Car Contract Template

Using a rent to own car contract template offers numerous advantages over crafting your own agreement, significantly simplifying the process and mitigating potential risks. Here’s why a template is a valuable resource:

1. Pre-Drafted Legal Language

Templates are carefully crafted by legal professionals to ensure compliance with relevant laws and regulations. This pre-drafted legal language ensures both parties are protected and reduces the risk of legal disputes.

2. Comprehensive Coverage

A well-designed template covers all essential aspects of a rent to own agreement, preventing any ambiguities or omissions. It ensures that every relevant condition, obligation, and responsibility is comprehensively addressed, minimizing the possibility of misunderstandings.

3. Streamlined Process

Utilizing a template eliminates the need to start from scratch when drafting the contract. It saves valuable time and effort, allowing you to focus on the crucial details of the agreement rather than getting bogged down in the legal nuances.

4. Reduced Risk of Errors

A template minimizes the risk of human errors, which could have significant legal implications. Its standardized structure and pre-filled sections ensure consistency and accuracy, reducing the chance of overlooked details or incorrect wording.

Finding a Reliable Rent to Own Car Contract Template

With the numerous benefits of using a template, you might wonder where to find a reliable and trustworthy resource. While there are various online options, it’s crucial to be cautious and prioritize sources known for their legal integrity.

Here are some trustworthy avenues for obtaining a rent to own car contract template:

1. Legal Websites and Resources

Websites specializing in legal documents and templates, such as LegalZoom or Rocket Lawyer, offer professionally drafted templates designed to meet legal standards. These platforms provide access to a library of templates, covering a wide range of legal topics, including rent to own contracts.

2. Attorneys and Legal Professionals

If you’re seeking a specialized template tailored to your specific needs, consulting an attorney or legal professional is the best option. They can provide personalized guidance and ensure the template accurately reflects the intricacies of your particular situation.

3. Government Websites

Government websites, such as those belonging to state or local authorities, may offer resources related to consumer contracts, including sample templates for rent to own agreements. While these templates might be less comprehensive than those offered by legal platforms, they can provide a foundation for drafting your own agreement.

Important Considerations Before Using a Template

While using a template offers significant advantages, it’s important to remember that every situation is unique. Simply using a template might not be sufficient; it’s crucial to personalize it to suit your specific needs and circumstances.

Here are some important considerations when using a template:

1. Review and Understand the Terms

Never sign any agreement without carefully reading and understanding every clause. Take the time to review the template thoroughly, paying close attention to the language used, the associated obligations, and the consequences of default. If you’re unsure about anything, don’t hesitate to seek clarification from a legal professional.

2. Tailor the Template to Your Needs

A template provides a solid foundation, but you must personalize it to match your unique circumstances. Adjust the language, fill in specific details like vehicle information and payment schedules, and modify clauses to reflect your individual requirements. This ensures the contract is customized to your specific needs and expectations.

3. Seek Legal Advice

While a template offers a helpful starting point, it’s essential to seek legal advice from a qualified attorney before signing the agreement. An attorney will review the template, identify any potential legal issues, and guide you through customizing the document to protect your interests.

Alternatives to Rent to Own Car Contracts

While rent to own contracts offer a unique solution for obtaining car ownership, exploring alternative financing options is essential to make informed decisions. Here are some viable alternatives:

1. Traditional Car Loans

Traditional car loans are a widely available option that allows you to borrow money to purchase a vehicle and repay the debt over time. While these loans may have higher interest rates than other forms of borrowing, they offer the benefit of building credit with timely payments.

2. Personal Loans

Personal loans can provide an alternative financing source for a car purchase. These loans are typically unsecured, meaning they don’t require collateral, but may come with higher interest rates compared to traditional car loans.

3. Car Leasing

Car leasing is a short-term agreement where you pay a monthly fee to use a vehicle for a set period. At the end of the lease, you can either return the car or purchase it at a predetermined price. While you won’t own the car outright in a lease, it can be a cost-effective option for short-term transportation needs.

Rent To Own Car Contract Template

Conclusion

A rent to own car contract template can be a valuable tool for individuals seeking a path towards car ownership. It offers transparency, legal protection, and a structured approach to acquiring a vehicle. Remember, thorough exploration of the contract terms, careful customization, and seeking legal guidance are crucial steps to ensuring a smooth and satisfying experience. While rent to own contracts present advantages, exploring alternative financing options like traditional car loans, personal loans, or car leasing will help you make the most informed decision for your specific circumstances. With careful planning and sound decision-making, you can navigate this alternative path towards financial freedom and the joy of owning the car you desire.

![Cyclomancy – The Secret of Psychic Power Control [PDF] Cyclomancy – The Secret of Psychic Power Control [PDF]](https://i3.wp.com/i.ebayimg.com/images/g/2OEAAOSwxehiulu5/s-l1600.jpg?w=740&resize=740,414&ssl=1)