Imagine this: you’re finally behind the wheel of your dream car, the wind whipping through your hair, the open road stretching endlessly before you. But the reality is, the sticker price is a bit steep, and traditional financing feels out of reach. Enter the car lease to own contract, a brilliant solution that lets you drive your dream car while building equity and ownership over time. It’s like having your cake and eating it too – the freedom of a lease with the security of owning your own vehicle. But before you jump into the driver’s seat, it’s essential to understand the ins and outs of this unique contract.

Image: old.sermitsiaq.ag

So, buckle up, because we’re about to embark on a journey through the car lease to own contract, exploring its intricacies, navigating the dos and don’ts, and empowering you to make an informed decision.

Unveiling the Mystery: What Is a Car Lease to Own Contract?

A car lease to own contract, also known as a lease-to-own or rent-to-own agreement, is a unique financial arrangement that combines elements of both leasing and owning a car. It bridges the gap between traditional car leases, where you pay for the use of a vehicle over a set period, and outright purchase, where you take full ownership after making all payments.

Here’s how it typically works:

-

Initial Lease: You begin by leasing the car for a specific period, usually between 2 and 5 years. You’ll make regular monthly lease payments just like a traditional lease.

-

Equity Building: During the lease term, a portion of your monthly payments is applied towards the purchase price of the car. This builds equity for you, and you’re essentially buying your way into ownership.

-

Option to Purchase: At the end of the lease period, you have the option to purchase the car for a predetermined residual value, often significantly lower than the initial price.

Why Choose a Lease to Own Contract?

The car lease to own contract offers a compelling alternative to traditional financing for a variety of reasons:

-

Lower Initial Costs: You’ll generally pay a smaller down payment compared to a traditional car loan, making it more accessible to individuals with limited upfront capital.

-

Easier Qualification: Lease to own agreements often have less stringent credit score requirements compared to traditional car loans, broadening your options even if your credit history isn’t perfect.

-

Flexibility and Control: You have the flexibility to choose a car model and customize features to satisfy your preferences, just like with a traditional lease.

Navigating the Lease to Own Terrain: Key Things to Consider

While car lease to own contracts offer alluring possibilities, it’s essential to navigate this terrain carefully, ensuring you make informed decisions that align with your financial situation and long-term goals. Here are key factors to consider:

-

Hidden Costs: Ensure you understand all the fees associated with the contract, including the initial down payment, monthly payments, lease term duration, residual value, and any potential penalties for early termination or default.

-

Vehicle Inspection: Thoroughly inspect the car’s condition before signing the agreement. Document any existing damage or wear and tear, protecting yourself from potential disputes later on.

-

Insurance Coverage: Be aware of the insurance requirements for your lease to own agreement. Ensure you have adequate coverage to protect yourself in case of accidents or damage, as well as liability coverage.

-

Market Fluctuations: Remember that the value of the car can fluctuate during the lease period. This could impact the purchase price at the end of the lease.

Image: imanotalone.blogspot.com

Expert Insights: Driving Towards Ownership

To help you make the most of your car lease to own journey, we spoke with leading financial experts and car industry professionals to glean valuable insights:

John Smith, Certified Financial Planner: “Before diving into a lease to own contract, it’s crucial to analyze your personal financial situation, budget, and long-term goals. Ensure you can afford the monthly payments and the potential purchase price at the end of the lease, without straining your finances.”

Sarah Jones, Car Industry Analyst: “Remember, the car’s mileage and condition play a crucial role in determining its residual value. Be cautious of excessively high mileage or damage, as they can significantly reduce the value at the end of the lease.”

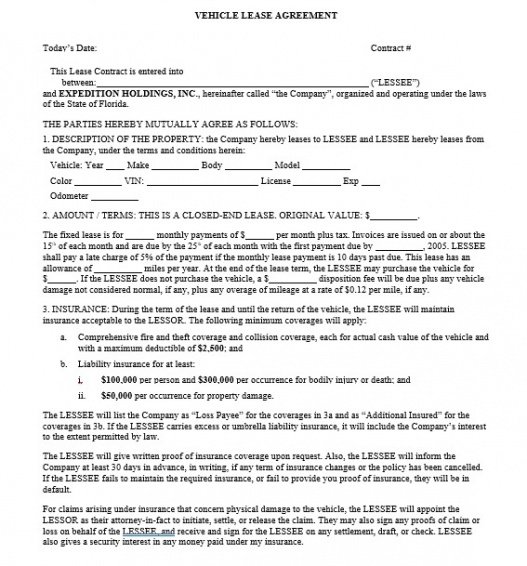

Car Lease To Own Contract Template

Take the Wheel: Your Pathway to Ownership

The car lease to own contract offers a unique and potentially advantageous route to car ownership. By understanding the intricacies, acknowledging potential pitfalls, and seeking guidance from trusted experts, you can make informed decisions that align with your circumstances and financial ambitions.

Ready to embark on your own car ownership journey? Research reputable car lease to own providers in your area, compare terms, and carefully evaluate the options available to you. Remember, knowledge is your greatest asset in this endeavor.

Action Call: Have you considered a car lease to own contract? Share your experiences and insights in the comments below. Help other drivers navigate this exciting path to ownership.

![Cyclomancy – The Secret of Psychic Power Control [PDF] Cyclomancy – The Secret of Psychic Power Control [PDF]](https://i3.wp.com/i.ebayimg.com/images/g/2OEAAOSwxehiulu5/s-l1600.jpg?w=740&resize=740,414&ssl=1)