Imagine this: you’re eagerly anticipating the arrival of your paycheck, but it never hits your bank account. Turns out, the wrong routing number was used in the transfer. This is a scenario that can happen to anyone, highlighting the crucial role of accurate routing numbers in our financial system. Today, we’ll delve into the world of routing numbers, specifically the St. Louis Federal Reserve routing number, and uncover its importance in ensuring smooth financial transactions.

Image: www.pinterest.com

While many banking transactions seem effortless, there’s a complex infrastructure in place that makes these transfers possible. The Federal Reserve, the central bank of the United States, is at the heart of this system, and the routing numbers assigned to each Federal Reserve Bank branch play a vital role in facilitating transactions.

Understanding Routing Numbers and Their Importance

What is a Routing Number?

A routing number, also known as a bank routing transit number (BRT), is a nine-digit code that identifies the specific financial institution and region where a bank account is held. Essentially, it’s like a postal code for money, directing transactions to the right place.

Imagine a complex network of pipes and valves. The routing number acts as a valve, ensuring that money flows through the correct branch of the network. When you send money through your bank, the routing number tells the Fed’s clearinghouse where that money needs to go.

The St. Louis Federal Reserve and Its Routing Number

The St. Louis Federal Reserve is one of twelve regional Federal Reserve Banks throughout the United States. Each Reserve Bank has a distinct routing number. The St. Louis Federal Reserve’s routing number is 071000027. This number is assigned to banks and financial institutions located within the Eighth Federal Reserve District, which encompasses parts of Missouri, Illinois, Indiana, Arkansas, Kentucky, Mississippi, Tennessee, and Louisiana.

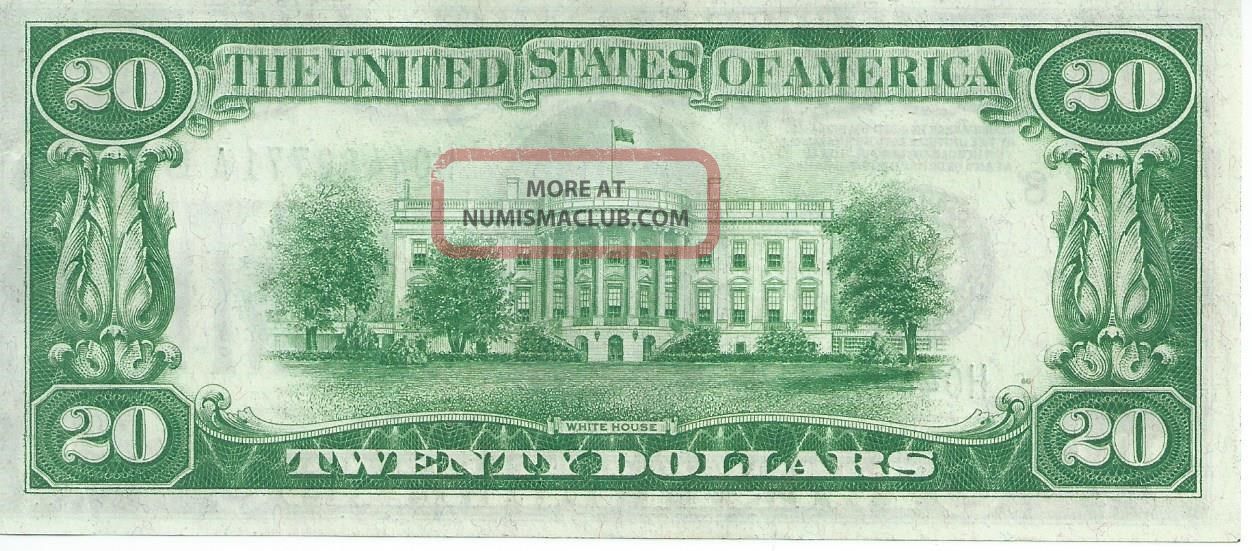

Image: numismaclub.com

How the St. Louis Federal Reserve Routing Number Works

When a financial institution within the Eighth Federal Reserve District initiates a transaction, such as a wire transfer or ACH payment, the routing number is included in the payment instruction. This number acts as a beacon, guiding the transaction to the correct Federal Reserve branch – in this case, the St. Louis branch.

The St. Louis Federal Reserve then processes the transaction, ensuring that the funds are routed to the designated recipient’s bank account. While the process may seem simple, the behind-the-scenes work of the St. Louis Federal Reserve ensures that transactions flow smoothly and securely between banks within its district.

Why Accuracy is Key

The consequences of using an incorrect routing number can be significant. It can delay your transaction, lead to failed transfers, and even result in your money being sent to the wrong bank altogether. Therefore, it’s crucial to double-check your routing number every time you make a financial transaction, particularly when dealing with new or unfamiliar institutions.

Always confirm your routing number with your financial institution before making a transaction. Websites like the Federal Reserve Bank of St. Louis’s website often have a directory of institutions within its district, providing readily accessible information about their routing numbers.

Tips and Expert Advice on Using Routing Numbers

Here are some additional tips to keep in mind when using routing numbers:

- Verify the routing number with your bank. Never rely on information from third-party websites or social media.

- Keep a record of your routing number in a safe place. You can find your routing number on your checks, bank statements, or through your online banking portal.

- Make sure to use the correct routing number for each transaction, especially when sending money to recipients in different banks. Each institution has its unique routing number.

By following these simple steps, you can help ensure that your financial transactions flow smoothly and reach their intended destinations.

Common Questions About Routing Numbers

Q: What happens if I enter the wrong routing number?

A: If you enter the wrong routing number, your transaction might be delayed, rejected, or even sent to the wrong bank. In some cases, retrieving your funds can be a complex process.

Q: How can I find my routing number?

A: You can usually find your routing number on your checks, bank statements, or through your online banking portal. Contact your bank if you can’t find it.

Q: Are routing numbers specific to bank branches?

A: Routing numbers are generally assigned to entire financial institutions, not specific branches. However, some institutions may have multiple routing numbers depending on their structure and location.

Q: Will my routing number ever change?

A: Routing numbers can change, but it’s fairly uncommon. If your bank does change its routing number, it will notify you in advance.

St Louis Federal Reserve Routing Number

Conclusion

The St. Louis Federal Reserve routing number plays a critical role in facilitating financial transactions within its district. Understanding its importance, ensuring accuracy, and following best practices can help you avoid delays, errors, and ensure the smooth flow of your finances. Remember, always double-check and verify your routing number before making any financial transactions!

Are you familiar with the importance of routing numbers in the financial system? Let us know your thoughts in the comments below!

![Cyclomancy – The Secret of Psychic Power Control [PDF] Cyclomancy – The Secret of Psychic Power Control [PDF]](https://i3.wp.com/i.ebayimg.com/images/g/2OEAAOSwxehiulu5/s-l1600.jpg?w=740&resize=740,414&ssl=1)