Imagine a world where businesses, like intricate tapestries, weave their financial stories through balance sheets and income statements. These documents, often viewed with a discerning eye by investors, tell a unique tale, a tale that speaks of growth, resilience, and the relentless pursuit of success. Today, we peel back the layers of Warner Company’s financial statements, unearthing the insights hidden within these numerical narratives.

Image: www.chegg.com

Beyond the rows and columns, these seemingly dry documents hold a vibrant history, mapping out a company’s journey. From the intricate dance of assets and liabilities in the balance sheet to the revealing peaks and valleys of income and expenses on the income statement, we’ll delve into the world of financial statements, empowering you to interpret these critical narratives and forge a path to informed decision-making.

The Balance Sheet: A Snapshot of Warner Company’s Financial Health

The balance sheet, often described as a company’s financial photograph, captures a moment in time, revealing the assets, liabilities, and equity that form the foundation of Warner Company’s financial standing. This snapshot highlights what the company owns (assets), what it owes (liabilities), and the value of its owner’s stake (equity).

- Assets: Imagine these as the company’s valuable possessions, the resources that drive its operations and fuel its growth. Assets range from tangible items like cash, inventory, and property to intangible assets like patents and trademarks. By studying the composition of Warner Company’s assets, we can gain insights into its investment strategies and industry focus.

- Liabilities: These represent the company’s financial obligations, the debts it owes to others. Liabilities can range from short-term obligations like accounts payable to long-term debts like loans. An analysis of Warner Company’s liabilities provides a detailed understanding of its financial leverage and its ability to manage its debt responsibilities.

- Equity: This represents the owner’s stake in the company, the value invested in its operations. Equity is often influenced by factors like profits, dividend payouts, and stock issuance. The breakdown of equity within Warner Company’s balance sheet offers a glimpse into the company’s ownership structure and its ability to attract and retain investment capital.

The Income Statement: A Window into Warner Company’s Performance

The income statement, often referred to as the profit and loss statement, chronicles the company’s performance over a specific period, typically a quarter or year. This document reveals how much revenue Warner Company has generated, the expenses it has incurred, and ultimately, its profitability.

- Revenue: This represents the total income Warner Company has earned from its core business activities. An analysis of revenue growth over time reveals the company’s ability to attract customers and expand its market share.

- Expenses: These are the costs incurred in generating that revenue. Expenses can range from the cost of goods sold to operating expenses and interest payments. Understanding the breakdown of expenses unveils the company’s cost structure, efficiency, and areas for potential optimization.

- Net Income: This is the bottom line, the difference between revenue and expenses. Net income reflects the company’s profitability, its ability to generate returns for its investors. A positive net income signifies that Warner Company is earning a profit, while a negative net income indicates a loss for the period.

Delving Deeper: Analyzing Trends and Ratios

The true power of financial statements lies in comparing them over time and analyzing key ratios. By examining trends in revenue, profit, and debt levels, we can identify patterns and gauge the company’s performance against industry benchmarks.

- Profitability Ratios: Ratios like gross profit margin and net profit margin unveil how effectively Warner Company is converting revenue into profit. These metrics provide insights into the company’s pricing strategies, cost controls, and overall efficiency.

- Liquidity Ratios: Ratios like current ratio and quick ratio measure Warner Company’s ability to meet its short-term financial obligations. These indicators help assess the company’s ability to manage its working capital and avoid financial distress.

- Solvency Ratios: Ratios like debt-to-equity ratio and interest coverage ratio shed light on Warner Company’s long-term financial health, revealing its reliance on debt and its capacity to meet interest payments.

Image: www.chegg.com

The Power of Financial Statement Analysis: A Tool for Informed Decision-Making

Beyond the numbers themselves, the true value lies in understanding the underlying story behind them. Financial statements are not just dry reports; they’re a window into a company’s past, present, and future. By deciphering their narratives, investors, analysts, and even potential customers can gain valuable insights into a company’s financial strength, growth potential, and ability to navigate the dynamic landscape of the business world.

Expert Insights: A Peek into the Mind of a Financial Analyst

“Financial statements are like a roadmap, guiding us through a company’s journey,” says renowned financial analyst, Mark Thompson. “They highlight potential opportunities and risks, providing valuable insights for investors and stakeholders alike. By understanding the key metrics and ratios, we can make informed decisions about whether to invest, partner, or support a company.”

Actionable Tips: Empowering You to Read Between the Lines

- Get Familiar with the Fundamentals: Start by understanding the essential components of the balance sheet and income statement. This foundational knowledge will serve as your guide as you delve deeper into the intricacies of financial analysis.

- Seek Out Reliable Sources: Consult reputable financial analysts, industry reports, and research publications to gain a comprehensive perspective on Warner Company’s performance and its industry landscape.

- Analyze Trends and Ratios: Look beyond the individual numbers and identify patterns and trends over time. By comparing financial statements across different periods, you can uncover insights that might otherwise remain hidden.

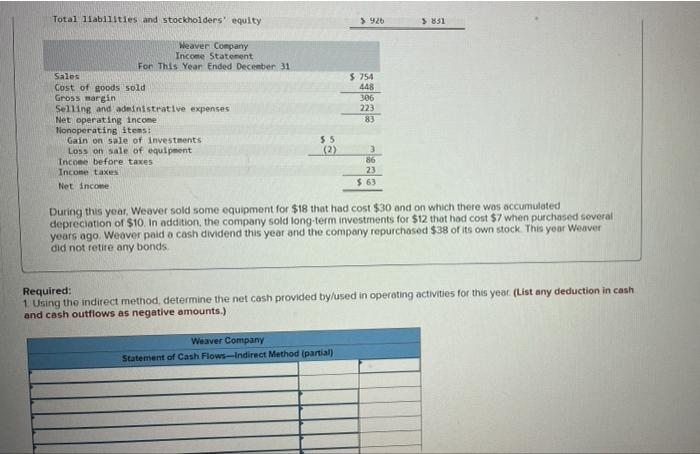

Presented Here Are The Financial Statements Of Warner Company

Beyond the Numbers: A Call to Action

The world of finance might seem complex, but it’s not insurmountable. These insights are merely the beginning of your financial literacy journey. Through continued learning and exploration, you can empower yourself to make informed decisions about your investments, your financial planning, and your understanding of the companies that impact your world. So, venture forth, explore the stories hidden within these numbers, and unlock the potential of your own financial journey.

![Cyclomancy – The Secret of Psychic Power Control [PDF] Cyclomancy – The Secret of Psychic Power Control [PDF]](https://i3.wp.com/i.ebayimg.com/images/g/2OEAAOSwxehiulu5/s-l1600.jpg?w=740&resize=740,414&ssl=1)