Ever felt the frustration of needing cash but being miles away from the nearest bank? In today’s fast-paced world, having convenient access to your funds is crucial. That’s where an ATM card comes in, allowing you to effortlessly withdraw cash from ATMs and make payments with ease. And if you’re an SBI customer, applying for an ATM card is a straightforward process.

Image: www.aiohotzgirl.com

This comprehensive guide will walk you through every step of the application process, from gathering the necessary documents to understanding the various types of cards available. We’ll also explore the benefits of owning an SBI ATM card and address any common questions you might have. So, buckle up and let’s dive into the world of SBI ATM cards!

Why Choose an SBI ATM Card?

Before we delve into the application process, let’s understand why choosing an SBI ATM card is a wise decision:

Wide Network Coverage:

SBI boasts an extensive network of ATMs across India, allowing you to access your money from virtually any location. This nationwide reach ensures convenience and peace of mind, no matter where your travels take you.

Multiple Card Types:

SBI offers a range of ATM cards to cater to different needs and preferences. Whether you’re looking for a basic debit card or a premium card with additional perks, SBI has something to suit your requirements.

Image: mikyui.com

Enhanced Security Features:

SBI prioritizes the security of your transactions. Their ATM cards are equipped with advanced security features like EMV chip technology and OTP authentication, safeguarding your money from unauthorized access. You can withdraw cash with confidence knowing your account is protected.

Convenient Online Banking and Mobile App:

SBI’s online banking platform and mobile app allow you to manage your account, track your transactions, and request an ATM card conveniently from the comfort of your home. You can even set up alerts for transactions and monitor spending patterns.

Preparing for Your Application

Before you head off to an SBI branch or submit an application online, ensure you have all the necessary documents readily available:

1. Valid Identity Proof:

A valid identity proof is crucial for verification purposes. Here are some accepted options:

- Aadhaar Card

- Voter ID Card

- Passport

- Driving License

- PAN Card

2. Address Proof:

Your application requires proof of residence. Common documents accepted are:

- Aadhaar Card

- Voter ID Card

- Passport

- Electricity Bill

- Telephone Bill

- Gas Bill

- Property Tax Receipt

3. Recent Passport-sized Photograph:

A clear and recent photograph is necessary for your ATM card. Ensure it is in the correct format and size as specified by SBI.

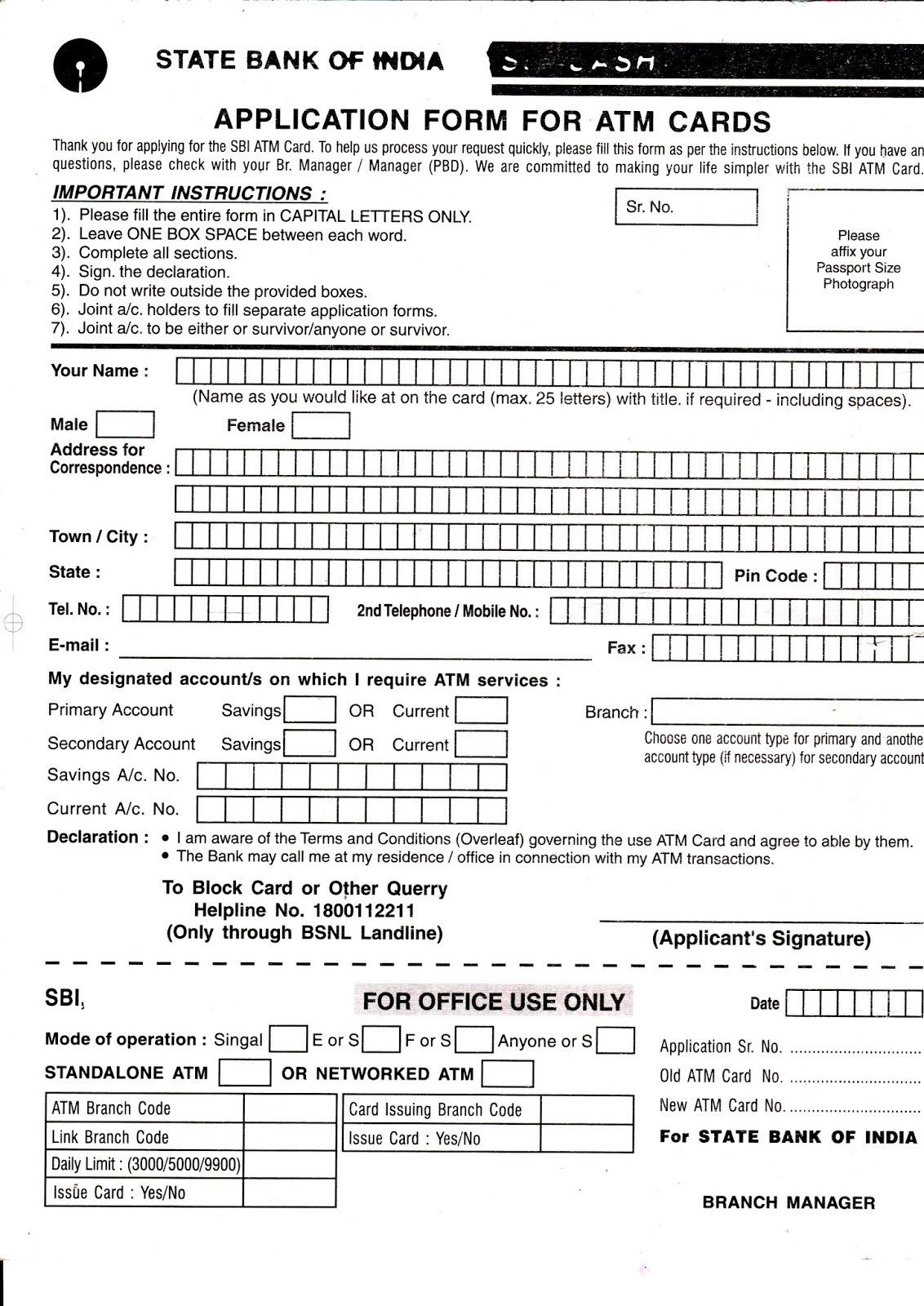

4. Completed Application Form:

SBI has an application form specific to ATM cards. You can either download it from their website or obtain it from a branch. Fill it out accurately and legibly, providing all required details.

5. Account Details:

You’ll need to provide your account number, account type, and branch details for the ATM card to be linked to your existing account. Ensure this information is accurate to avoid delays in the processing of your application.

Applying for an SBI ATM Card

Now, let’s explore the various ways you can apply for an SBI ATM card. Choose the method that best suits your convenience:

1. Visiting an SBI Branch:

This is the traditional method of applying. Visit your nearest SBI branch with all the required documents mentioned earlier. A bank representative will assist you in filling out the application form and guide you through the process. While this method ensures personal interaction, it might require a visit to the branch during working hours.

2. Applying Online:

SBI provides an online application process for ATM cards. Visit the SBI website, navigate to the ‘ATM Card’ section, and follow the instructions. You’ll need to provide your personal and account details along with uploaded documents. This method offers convenience, allowing you to apply anytime from anywhere.

3. Using the SBI YONO Mobile App:

SBI’s mobile banking app, YONO, offers an effortless way to apply for an ATM card. Simply log in to the app, navigate to the ‘Cards’ section, and select ‘ATM Card’. Follow the on-screen instructions and upload the required documents. The app ensures a streamlined and intuitive experience, simplifying the application process.

Types of SBI ATM Cards

SBI offers a variety of ATM cards to suit diverse needs. Let’s explore some popular options:

1. Basic Debit Card:

The standard debit card offers access to your account for cash withdrawals and point-of-sale (POS) transactions. It’s ideal for basic banking needs and comes with a PIN for security.

2. RuPay Debit Card:

RuPay is India’s domestic card payment network. SBI’s RuPay debit cards provide access to a wide range of merchants and ATMs within India. They are known for their affordability and convenience.

3. Visa Debit Card:

Visa is a globally recognized card network. SBI’s Visa debit cards provide access to ATMs and merchants worldwide, making them suitable for international travel and online shopping. They often come with additional benefits and rewards programs.

4. Mastercard Debit Card:

Similar to Visa, Mastercard is a global card network. SBI’s Mastercard debit cards offer widespread acceptance, providing convenience for both domestic and international transactions. They may also include loyalty programs and other perks.

5. Prepaid Debit Card:

SBI’s prepaid debit cards are a convenient way to manage spending. They allow you to load a specific amount of money and use it for purchases and ATM withdrawals. These cards are ideal for children and individuals looking for controlled spending.

6. Corporate Debit Card:

SBI offers corporate debit cards specifically designed for businesses. These cards allow companies to manage employee expenses effectively and streamline procurement processes.

Additional Information

Here are some essential facts to consider:

1. Fees and Charges:

SBI charges fees for issuing and maintaining ATM cards. These fees vary depending on the type of card and the account you hold. It’s essential to inquire about the fees before applying to make an informed decision.

2. Activation Process:

Once your application is approved, you’ll receive an ATM card through courier or in-branch pickup. Follow the instructions provided to activate your card and set a PIN.

3. Card Limits:

Your ATM card will have pre-defined daily and monthly withdrawal limits. These limits can be increased by contacting SBI customer service.

4. Customer Support:

SBI provides dedicated customer service channels for any queries or issues related to your ATM card. You can contact them through their website, mobile app, phone, or by visiting a branch.

5. Important Security Measures:

To ensure the safety of your ATM card and prevent fraud:

- Keep your PIN confidential and never share it with anyone.

- Be cautious when entering your PIN at ATMs or POS terminals. Avoid using machines in crowded or dimly lit areas.

- If your card is stolen or lost, report it immediately to SBI to prevent unauthorized use.

- Regularly monitor your account statements for suspicious transactions.

Application Form For Atm Card Sbi

Conclusion

Obtaining an SBI ATM card is a straightforward process that can significantly enhance your banking convenience. By carefully following the steps outlined in this guide, you can apply for the card best suited to your needs and enjoy the benefits of secure and convenient access to your funds. Remember to choose the right type of card depending on your usage patterns and stay updated on the latest security measures for protecting your account.

Ready to embark on your journey towards a convenient and secure banking experience? Apply for your SBI ATM card today and unlock a world of possibilities!

![Cyclomancy – The Secret of Psychic Power Control [PDF] Cyclomancy – The Secret of Psychic Power Control [PDF]](https://i3.wp.com/i.ebayimg.com/images/g/2OEAAOSwxehiulu5/s-l1600.jpg?w=740&resize=740,414&ssl=1)