Remember that time you were trying to balance your checkbook, and you just couldn’t get the numbers to match? That feeling of frustration is something every accountant, business owner, and even casual budgeter experiences at some point. The good news is, there’s a simple framework for understanding how financial transactions impact your money – the accounting equation. It’s like a secret decoder ring for your finances, making sense of all those Debits and Credits!

Image: derivbinary.com

This article is part three in our series, diving deeper into the accounting equation. We’ll explore how different types of transactions, like sales, purchases, and payments, actually change the equation. By the end, you’ll not only understand the basic structure, but you’ll be able to confidently analyze how any transaction impacts a company’s financial health.

The Accounting Equation: A Recap

At its core, the accounting equation states: Assets = Liabilities + Equity. Think of it like a simple seesaw. The assets are what the company owns – cash, inventory, buildings – and they sit on one side of the seesaw. The liabilities represent what the company owes to others – loans, unpaid bills – and those sit on the other side. Finally, equity represents the owner’s stake in the business.

The beauty of the accounting equation is that it must always remain balanced. If something happens on one side – an asset increases, a liability decreases, or equity changes – there needs to be a corresponding change on the other side. This balancing act ensures that the accounting records accurately reflect a company’s financial position at any given time.

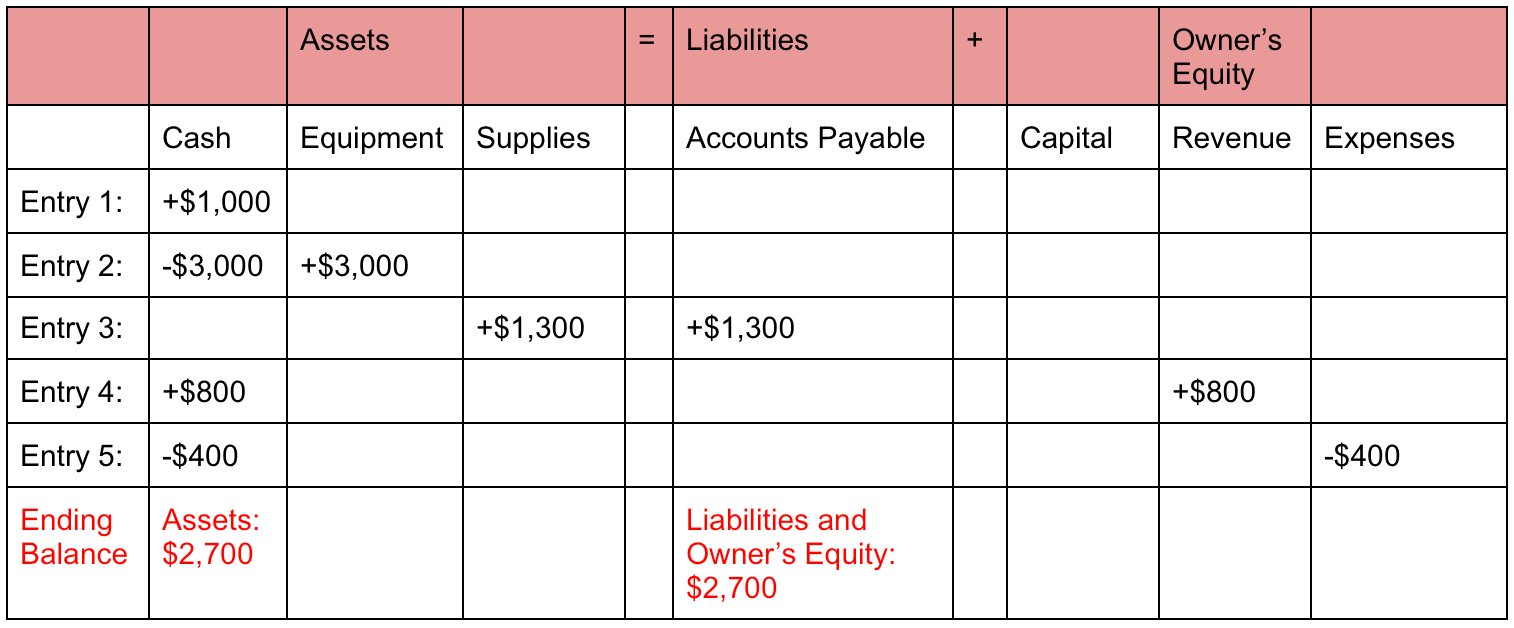

Understanding Transactional Impacts

Transactions Affecting Assets

Every transaction involves a change, whether it’s an increase or decrease, in one or more of the elements in the accounting equation. For example, let’s say a company purchases inventory. This transaction affects two parts of the equation:

- Assets increase: Inventory, an asset, is added to the company’s holdings.

- Liabilities increase (or Equity decreases): The company either paid cash (decreasing another asset), took out a loan (increasing a liability), or used retained earnings (decreasing equity) to finance the purchase.

The accounting equation remains balanced because the increase in one side is offset by an equal increase on the other side.

Image: www.chegg.com

Transactions Affecting Liabilities

Next, consider a transaction where a company receives a loan. Here’s how the transaction impacts the accounting equation:

- Assets increase: Cash, an asset, increases because the company now has more money.

- Liabilities increase: The loan itself increases the company’s liabilities as it now owes money to the lender.

Transactions Affecting Equity

Finally, let’s say a company generates profit. This transaction directly impacts the equity portion of the equation:

- Equity increases: Profit increases retained earnings, a part of equity.

Though not always directly, a profit eventually leads to an increase in assets, as the company can use that profit to buy more inventory, equipment, or even pay off debt, impacting the equation on both sides.

Tips for Analyzing Transactions

To become adept at understanding how transactions affect the accounting equation, here are a few tips from experienced accountants:

- Identify the accounts involved: Every transaction affects at least two accounts. Start by pinpointing which accounts are directly impacted.

- Determine the direction of the change: Does the transaction increase or decrease the account value?

- Apply the accounting equation: Ensure that the changes on each side of the equation are balanced. Remember that any increase on one side needs a corresponding increase or decrease on the other side.

- Think of the transaction as a story: Visualizing the transaction helps. For example, imagine the company physically receiving the inventory or paying cash for it. This can make it easier to understand the impact on the accounting equation.

FAQ

What if a transaction doesn’t seem to fit the accounting equation?

If a transaction doesn’t seem to make sense, it might be because you’re missing a key element. Revisit the transaction and make sure you’ve identified all the accounts involved. One example might be a purchase on credit – while it might initially seem like only inventory is increased, an accounts payable (liability) also increases.

How important is it to understand the accounting equation?

Knowing how to utilize the accounting equation is crucial for anyone involved in business. It provides a clear and concise framework to understand how every financial decision impacts a company’s financial health. It’s a powerful tool for making informed decisions, managing finances effectively, and ultimately, making sure your business thrives!

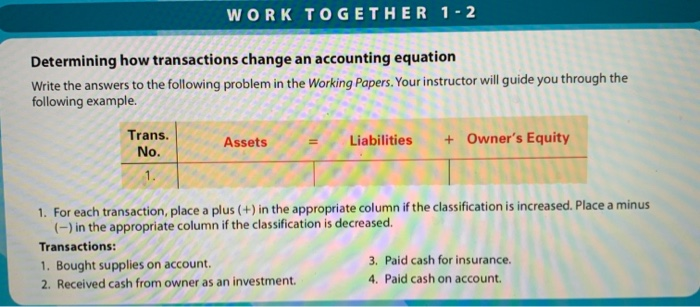

Part Three Determining How Transactions Change An Accounting Equation

Conclusion

While the accounting equation might seem basic at first, mastering it unlocks a deeper understanding of financial transactions. This knowledge can be applied to personal finances, business analysis, and even investment decisions. By analyzing the impact of every transaction, you can confidently track your company’s or your personal financial progress.

Are you ready to delve deeper into the world of accounting? Share your thoughts and ask any questions you have in the comments below. Let’s discuss your journey toward mastering the accounting equation!

![Cyclomancy – The Secret of Psychic Power Control [PDF] Cyclomancy – The Secret of Psychic Power Control [PDF]](https://i3.wp.com/i.ebayimg.com/images/g/2OEAAOSwxehiulu5/s-l1600.jpg?w=740&resize=740,414&ssl=1)