Have you ever wished for a smoother, swifter way to interact with your bank? Picture this: you need to update your address, make a change to your account, or request a specific service, and you can do it all online, hassle-free. The State Bank of India (SBI) Customer Request Form is your digital gateway to these convenient services, eliminating the need for long queues and physical visits to branches.

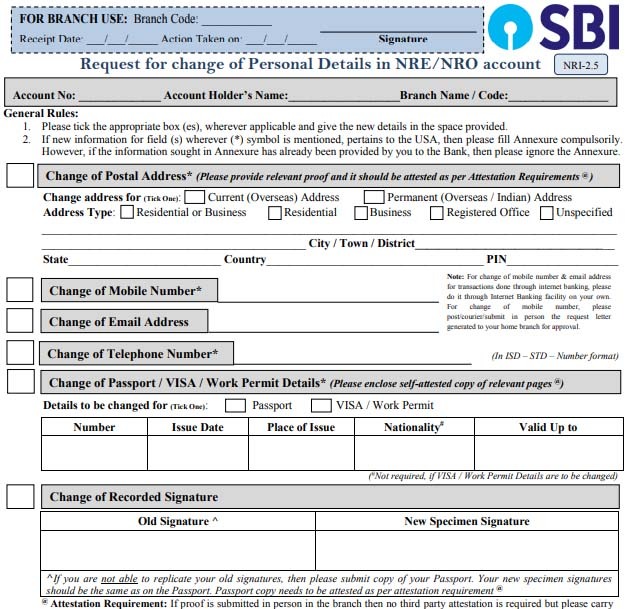

Image: www.uslegalforms.com

But let’s be honest, navigating the world of online forms, especially with a large financial institution like SBI, can feel daunting. Fear not! This comprehensive guide will demystify the SBI Customer Request Form, revealing its potential and showing you exactly how to navigate it. We’ll uncover the types of requests you can submit, the steps involved, and common FAQs. Get ready to simplify your banking experience and empower yourself with the convenience of online solutions.

A Digital Gateway for Your Banking Needs

The SBI Customer Request Form is your one-stop shop for several essential banking services. Designed for streamlined communication and efficiency, it empowers you to directly engage with the bank, request assistance, and manage your accounts effortlessly. Whether you need to update your account information, apply for a new service, or resolve an issue, this form streamlines the process.

What Requests Can You Submit?

The SBI Customer Request Form encompasses a wide range of services, catering to your diverse banking needs. Here’s a snapshot of the most common requests you can submit:

- Account Related: Update contact details, address changes, name corrections, account closure, and more.

- Transactions: Stop payments, reverse transactions, inquire about pending transactions, and manage daily banking operations.

- Cards: Report lost or stolen cards, request replacements, change PINs, and manage card limits.

- Loan Applications: Apply for personal loans, home loans, or other credit facilities.

- General Enquiries: Seek clarification on account statements, fees, charges, and other banking-related queries.

- Complaints and Feedback: Share your concerns, suggestions, and recommendations directly with SBI.

How to Navigate the SBI Customer Request Form

Mastering the SBI Customer Request Form is easier than you think. Just follow these simple steps:

Image: www.samplefilled.com

1. Access the Form:

- Visit the official SBI website and navigate to the customer service section.

- You’ll typically find a dedicated “Customer Request Form” tab or link.

2. Select Your Request Category:

- The form will present a list of categories related to your request.

- Choose the category that best aligns with your need. For example, “Account Related”, “Transactions”, “Cards”, etc.

3. Provide Detailed Information:

- Each category will likely have specific fields to fill out.

- Provide accurate and complete details about your request.

4. Attach Relevant Documents:

- If your request requires supporting documentation, ensure you have the necessary documents readily available.

- These documents may include scanned copies of your ID proof, address proof, bank statements, etc.

5. Submit Your Request:

- Once you’ve filled out all the required information and attached any necessary documents, submit your request.

6. Track Your Request:

- You will typically receive a reference number or acknowledgement email upon submission. Keep this information handy for tracking the status of your request.

7. Expect a Response:

- SBI will process your request, review it, and respond accordingly.

- You may receive an email, SMS notification, or a call regarding the outcome of your request.

Tips for Smooth Sailing

- Clarity is key: Be precise in your descriptions and avoid ambiguity.

- Read instructions carefully: Pay attention to the specific details and requirements of each category.

- Double-check your information: Before submitting, ensure all details are correct to avoid errors.

- Be patient: Processing times may vary depending on the complexity of your request.

- Retain all communication: Save any emails, SMS messages, or call logs related to your request for future reference.

Beyond the Online Form: Additional Channels

While the SBI Customer Request Form is a convenient option, remember that you also have other channels available for engaging with the bank.

- Call Centers: Contact their 24/7 customer care helpline for immediate assistance.

- Branch Visits: For complex issues or personalized support, you can visit your nearest SBI branch.

- Social Media: Connect with SBI through their official social media pages for updates and information.

The Future of Banking: Seamless Digital Communication

The SBI Customer Request Form is a testament to the evolution of banking toward a more digital, customer-centric approach. It empowers you to manage your finances with ease and engage directly with the bank, all from the comfort of your home. As technology advances, we can anticipate even more innovative solutions that further simplify banking processes and enhance customer experience.

Customer Request Form State Bank Of India

Embracing the Digital Transformation

Don’t let the fear of online forms hold you back. The SBI Customer Request Form offers a simple, efficient way to connect with your bank, resolve issues, and manage your finances. Embrace the digital transformation and unlock the potential of this powerful tool for a seamless and convenient banking experience.

By understanding the benefits, navigating the process, and leveraging the diverse communication channels at your disposal, you can confidently manage your SBI accounts and maximize your banking efficiency. You’ll be well-equipped to embrace the digital future of banking while enjoying the convenience of online solutions.

![Cyclomancy – The Secret of Psychic Power Control [PDF] Cyclomancy – The Secret of Psychic Power Control [PDF]](https://i3.wp.com/i.ebayimg.com/images/g/2OEAAOSwxehiulu5/s-l1600.jpg?w=740&resize=740,414&ssl=1)