Imagine this: you’re diligently saving for your dream home, pouring every spare dollar into your savings account. Then, you decide to compare mortgage rates, knowing it’s smart to shop around. You visit a few lenders, excited to find the perfect deal.

Image: tobymills.z19.web.core.windows.net

But then, you get a shock: your credit score drops! You find out that those innocent rate checks, intended to help you, negatively impacted your credit report in the form of hard inquiries. You’re left wondering, “What can I do to fix this?” Well, the good news is, there’s a way to rectify this situation and potentially restore your credit score to its pre-inquiries glory. This guide will equip you with the knowledge you need to navigate hard inquiries and fight for the removal of those unwanted marks on your credit report.

Understanding Hard Inquiries and Their Impact

Before delving into the letter writing process, let’s define what a hard inquiry is and its implications. Simply put, a hard inquiry is a record of a lender accessing your credit report to evaluate your creditworthiness. These instances can occur when you apply for:

- Credit Cards: Whether you’re seeking a new card with rewards or a lower interest rate, each application typically triggers a hard inquiry.

- Mortgages: As mentioned earlier, comparing mortgage rates involves pulling your credit report, resulting in multiple hard inquiries.

- Personal Loans: Looking for a personal loan to consolidate debt or finance a major purchase? Expect a hard inquiry on your credit report.

- Auto Loans: Whether buying a new or used car, your credit history is reviewed, resulting in a hard inquiry.

While necessary for lenders to assess your financial responsibility, hard inquiries can negatively impact your credit score. Each inquiry can shave off a few points, potentially hindering your chances of getting approved for loans, especially at favorable interest rates. Even if you’re not actively searching for credit, you might experience a hard inquiry if:

- Existing Lenders make a hard pull on your credit report, sometimes without your consent, when there’s a change in your account, like a balance transfer or a line of credit increase.

- You’re a co-signer on someone else’s loan: If the primary applicant’s credit is checked, you might also receive a hard inquiry.

- You’re a victim of credit fraud: In this unfortunate circumstance, you may find unauthorized hard inquiries on your credit report.

How Long Do Hard Inquiries Stay on Your Credit Report?

Despite their negative impact on your credit score, the good news is that hard inquiries typically only remain on your credit report for two years. This means that their impact gradually diminishes over time. However, the most recent inquiries have the strongest influence on your score.

The Power of a Letter: Requesting Hard Inquiry Removal

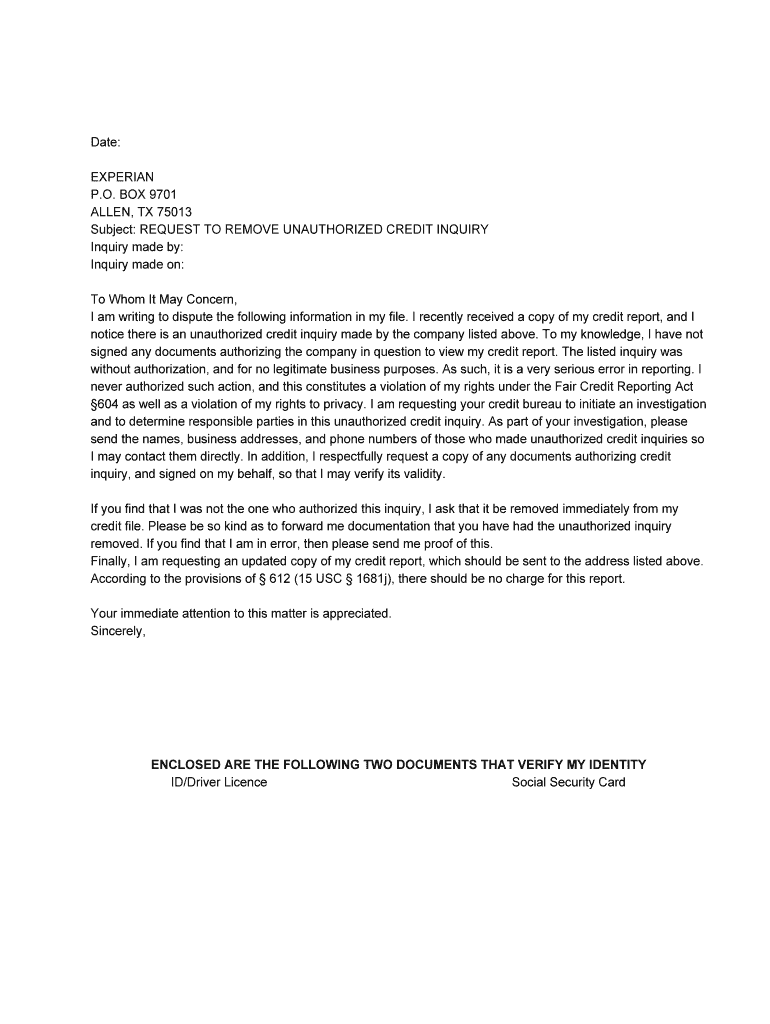

Knowing that hard inquiries can negatively affect your credit score, it’s crucial to understand how to request their removal. The process involves sending a carefully crafted letter to the credit bureau where the inquiry appears. While each credit bureau (Equifax, Experian, and TransUnion) has its own formatting and address guidelines, the general structure remains consistent.

Here’s a breakdown of what to include in your letter for hard inquiry removal:

1. Your Contact Information: Begin by providing your full name, address, phone number, and email address. This ensures the credit bureau can easily reach you.

2. Credit Bureau Address: Specify the credit bureau you’re writing to. For instance, you might address the letter to “Equifax, Inc., PO Box 740256, Atlanta, GA 30374-0256.” You can find the correct addresses on each credit bureau’s website.

3. Account/Inquiry Details: Clearly identify the specific hard inquiry you wish to dispute. Include the date of the inquiry, name of the lender, and any other relevant information.

4. Reason for Dispute: Explain why you believe the inquiry should be removed. This is where your strong statement lies. For example, you might state:

- “I did not authorize this credit inquiry.” This is especially helpful if you suspect fraud.

- “This inquiry was generated from comparing mortgage rates, and I only initiated a limited number of inquiries within a short timeframe.” This highlights your responsible shopping behavior.

- “My name was mistakenly used on this credit application.” This approach is relevant if you were a victim of identity theft.

5. Supporting Documentation: Attach all relevant documents to strengthen your case.

These include:

- A copy of your credit report showing the disputed inquiry.

- Documentation from any lenders involved, confirming that you did not pursue a credit application with them.

- Police reports or other documents, if you’re a victim of identity theft.

6. Request for Removal: Clearly state your request to “remove the inaccurate hard inquiry from my credit report.” You can also express your expectation for a prompt response and be sure to keep a copy of your letter for your records.

Image: templates.esad.edu.br

Example Letter for Hard Inquiry Removal

Here’s a sample letter incorporating the elements mentioned above:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Today’s Date]

Equifax, Inc.

PO Box 740256

Atlanta, GA 30374-0256

RE: Dispute Hard Inquiry – [Date of Inquiry]

Dear Equifax,

This letter serves as a formal dispute regarding a hard inquiry appearing on my credit report. The inquiry was initiated by [Name of Lender] on [Date of Inquiry] and is listed on my Equifax credit report.

I believe this inquiry should be removed as [Reason for Dispute]. For example, you might state: “I did not apply for credit with [Name of Lender] on [Date of Inquiry]. I have not authorized any individual to use my personal information for a credit application.”

To support my claim, I have enclosed a copy of my Equifax credit report displaying the disputed inquiry. [If applicable, add: “I have also included documentation from [Name of Lender] confirming that I did not apply for credit with them.”]

I kindly request that you remove this inaccurate hard inquiry from my credit report and provide me with written confirmation of its removal.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

Submitting Your Letter and Following Up

After carefully drafting your letter, you have a few options:

- Mail: Send your letter certified mail with a return receipt requested. This method ensures you receive confirmation of delivery.

- Online: Many credit bureaus offer online dispute forms on their websites. This provides a convenient option for submitting your inquiry.

- Fax: You can often fax your dispute letter directly to the credit bureau. Check their website for the appropriate fax number.

After submitting your request, patiently wait for a response from the credit bureau while keeping a copy of your correspondence and any supporting documents. If you haven’t received a response within 30 days, don’t hesitate to follow up through phone, email, or even a registered letter.

Strategies for Managing Hard Inquiries

Once you’ve submitted your dispute letter, here are some proven strategies for managing hard inquiries and minimizing their impact:

- Be Proactive: Whenever you apply for a loan, carefully review the lender’s practices and inquire about how they handle hard inquiries.

- Utilize Soft Inquiries: For credit checks that don’t affect your score, like pre-approvals, use soft inquiries whenever possible.

- Maximize Credit Use: Increase your credit utilization ratio to 30% or less, as this shows lenders you’re managing your credit responsibly. This can partially offset any negative points from hard inquiries.

Letter For Removal Of Hard Inquiry

The Bottom Line: Understanding and Combating Credit Inquiries

Remember, a hard inquiry is just one factor in the complex credit scoring system. Regularly checking your credit report, being proactive with your finances, and understanding your credit score’s components are crucial. While hard inquiries may temporarily cause a dip in your score, your proactive efforts to dispute them and maintain responsible credit habits will help you achieve a healthy credit profile in the long run.

By taking charge of your financial health, you can navigate the world of credit inquiries with confidence and ultimately achieve your financial goals!

![Cyclomancy – The Secret of Psychic Power Control [PDF] Cyclomancy – The Secret of Psychic Power Control [PDF]](https://i3.wp.com/i.ebayimg.com/images/g/2OEAAOSwxehiulu5/s-l1600.jpg?w=740&resize=740,414&ssl=1)