Have you ever felt frustrated when you saw an inaccurate or outdated item on your credit report? You’re not alone. Many people face this problem, which can significantly impact their ability to obtain loans, rent an apartment, or even secure a job. But what can you do about it? The good news is, you have the right to dispute inaccurate information on your credit report, and using a free printable 609 credit dispute letter template can be a powerful tool in your arsenal.

Image: www.heritagechristiancollege.com

This guide will dive into the world of credit dispute letters, exploring how they work, why a free 609 template is valuable, and how you can leverage this tool for a better financial future. We’ll break down the legalities, the process, and even provide tips for crafting effective letters. So, let’s get started and equip you with the knowledge to take control of your credit report and achieve a positive financial outcome.

Understanding the Power of Credit Disputes

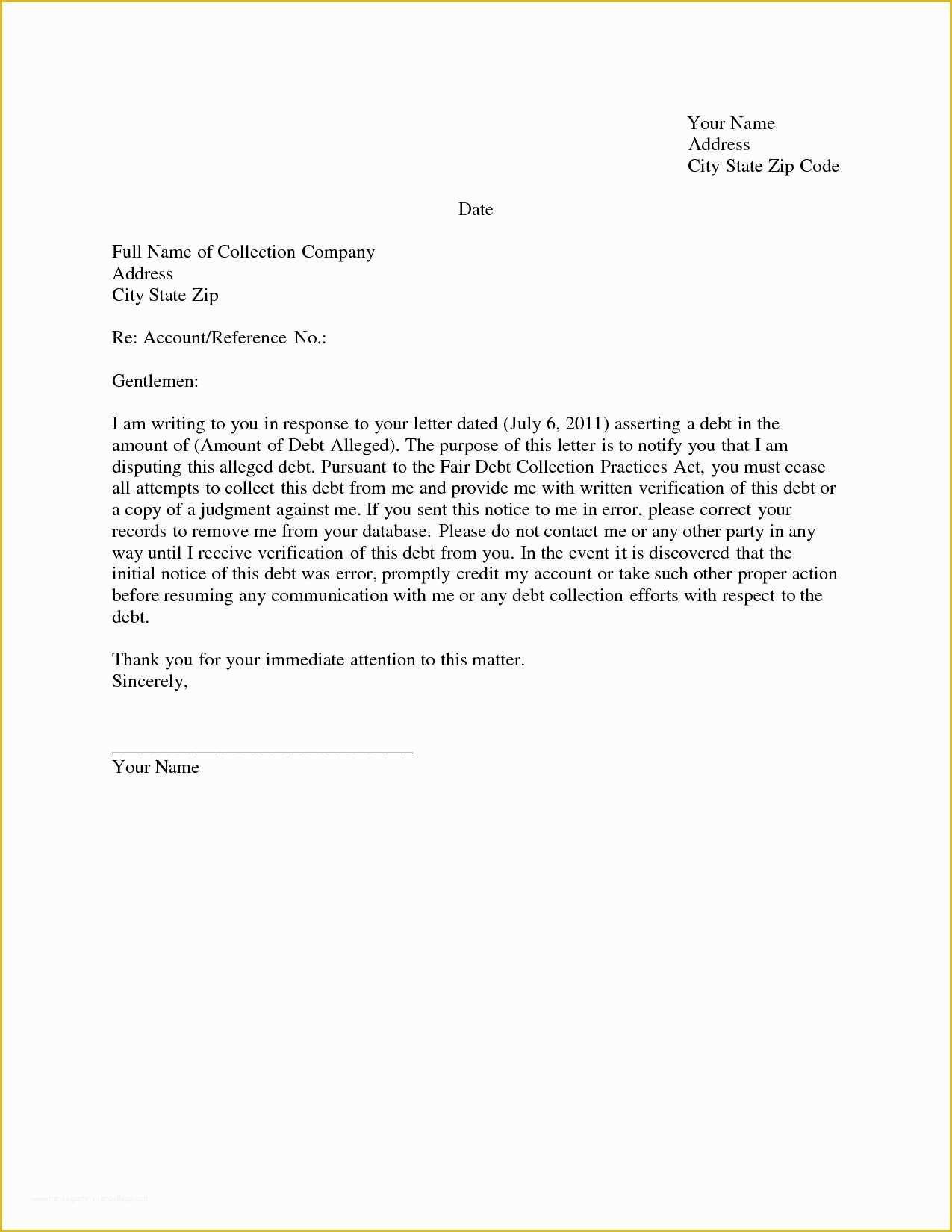

The Fair Credit Reporting Act (FCRA) is your legal shield when it comes to credit reporting accuracy. It gives you the right to dispute any inaccurate or unverifiable information on your credit report. The FCRA requires credit bureaus (like Equifax, Experian, and TransUnion) to investigate your dispute and take action if they find errors. This is where the 609 credit dispute letter template comes into play.

A 609 credit dispute letter, named after the relevant section of the FCRA, is a formal document you send to the credit bureaus to demand the correction of inaccurate information. These letters are your official communication, and they must be accurate and properly formatted to ensure they are taken seriously.

The Importance of a Free 609 Credit Dispute Letter Template

While crafting a 609 credit dispute letter yourself is possible, using a free template offers several advantages:

- Accurate Formatting: Templates ensure your letter adheres to the legal requirements and specifications set by the FCRA, making your dispute more likely to be taken seriously.

- Clear Language: Templates provide a well-defined structure and use precise language, minimizing the risk of misinterpretation or ambiguity.

- Time-Saving: Templates eliminate the hassle of figuring out what to include and how to format your letter, allowing you to focus on the content and details of your dispute.

- Cost-Effective: Free templates are, well, free! You can save money on legal or professional letter-writing services.

Finding the Right Free 609 Credit Dispute Letter Template

The internet is a treasure trove of free printable 609 credit dispute letter templates. To find the right template for you, consider these factors:

- Specificity: Look for templates that cater to the specific type of error you are disputing. Whether it’s a collection account, a late payment, or identity theft, there are likely templates designed for each.

- User Friendliness: Choose a template that is easy to understand and navigate, with clear instructions and blank fields for your information.

- Legitimate Source: Trustworthy websites like government agencies, consumer advocacy groups, and reputable financial organizations are good sources for free templates. Avoid websites offering templates for a fee or those that seem unreliable.

Image: www.heritagechristiancollege.com

Key Elements of a 609 Credit Dispute Letter

A well-crafted 609 credit dispute letter should include the following essential components:

- Your Personal Information: Your full name, address, phone number, and social security number.

- Credit Bureau Information: The name and address of the credit bureau you are contacting.

- Specific Details of the Dispute: Clearly identify the account or item you are disputing, including the account number, creditor’s name, date of the error, and the correct information if known.

- Reason for Dispute: Explain why you believe the information is inaccurate or unverifiable. Be specific and detailed, providing any supporting documentation you may have, such as receipts or copies of bills.

- Request for Action: Clearly state your request, whether it is to remove the item entirely or update it with the correct information.

- Closing Statement: Politely end the letter with a closing statement and your signature.

Crafting Your Letter: Tips for Success

While a free template provides a strong foundation, remember that your letter is your voice. Here are some tips for crafting an effective credit dispute letter:

- Stay Professional and Courteous: Keep your tone professional, even if you are frustrated. Avoid using accusatory or inflammatory language.

- Be Concise and Specific: State your case clearly and concisely, focusing on the facts and avoiding unnecessary jargon or personal opinions.

- Provide Supporting Documentation: Whenever possible, back up your claims with evidence. This could include copies of bills, payment confirmations, or police reports in cases of identity theft.

- Follow Up: If you don’t hear back from the credit bureau within 30 days of sending your dispute, follow up with a phone call or a reminder letter. Keep records of all your communications.

What Happens After You Send Your Dispute

Once the credit bureau receives your dispute letter, it has 30 days to investigate your claim. During this time, they will contact the creditor or other information provider to verify the accuracy of the item in question. There are three possible outcomes:

- The dispute is validated: If the credit bureau finds the item is inaccurate, they will remove it from your credit report. You’ll receive a notification of this change and an updated credit report.

- The dispute is not validated: If the credit bureau confirms the item is accurate, they will not remove it. You will receive a notification explaining their decision and your options for appealing the decision.

- The credit bureau can’t verify the disputed item: If the credit bureau cannot verify the accuracy of the item, they must remove it from your report. You will receive a notification of this change.

Taking Action: Your Next Steps

Now that you understand the benefits of using a free 609 credit dispute letter template and the entire dispute process, you’re ready to take action. Follow these steps:

- Review Your Credit Report: Obtain a free copy of your credit report from each of the three major credit bureaus. It’s a good idea to do this regularly, at least once a year. You can obtain your free reports from www.annualcreditreport.com.

- Identify Any Errors: Carefully review your credit reports for any inaccuracies or outdated information. This could include closed accounts that are still listed, late payments that shouldn’t be there, or even someone else’s debt.

- Download and Use a Free 609 Credit Dispute Letter Template: Search for a free template that aligns with the specific types of errors you’ve discovered. There are many excellent resources available online.

- Complete Your Template: Fill out the template with your accurate personal information, the specific details of your dispute, and any relevant supporting documents.

- Send Your Letter: Mail your completed 609 credit dispute letter to each of the credit bureaus where the inaccurate information appears. Remember to keep copies of your letters and any supporting documentation for your records.

Printable Free 609 Credit Dispute Letter Templates

Conclusion

Using a free 609 credit dispute letter template empowers you to challenge inaccurate information on your credit report, potentially improving your credit score and giving you access to better financial opportunities. Don’t let errors on your credit report hinder your progress. Take charge today and start the dispute process with confidence. Remember to review your credit report regularly and stay informed. By taking these steps, you can contribute to building a positive financial future for yourself.

![Cyclomancy – The Secret of Psychic Power Control [PDF] Cyclomancy – The Secret of Psychic Power Control [PDF]](https://i3.wp.com/i.ebayimg.com/images/g/2OEAAOSwxehiulu5/s-l1600.jpg?w=740&resize=740,414&ssl=1)