Remember that first accounting class, filled with unfamiliar terms like debits, credits, and balance sheets? The sheer volume of information can be daunting, but conquering those introductory concepts is crucial for anyone venturing into the world of finance. One of the most common ways to solidify your understanding is through practice sets, and Mini Practice Set 1 is often a staple in introductory accounting courses.

Image: mini-practice-set-4-accounting-answers.pdffiller.com

But let’s be honest, even with the best intentions, we’ve all been there—stuck on a question, staring at a spreadsheet, wondering if we’re on the right track. That’s why, in this article, we’ll dive deep into the solutions for Mini Practice Set 1, demystifying the problems and providing a step-by-step guide to help you ace those accounting fundamentals. It’s time to turn that confusion into confidence!

Understanding Mini Practice Set 1: A Foundation for Financial Literacy

Mini Practice Set 1 is designed to introduce students to the basic principles of accounting, laying the groundwork for more complex financial analysis later on. You’ll encounter scenarios involving transactions, recording them in the accounting system, and interpreting the resultant financial statements.

The practice set typically covers several key areas including:

- Journalizing Transactions: The process of recording business transactions in a journal, using debits and credits to reflect the impact on accounts.

- Posting to Ledgers: Transferring data from the journal to individual accounts in the general ledger, summarizing the financial activity in each account.

- Trial Balance: A list of all accounts and their balances, ensuring that debits and credits are equal, confirming the accuracy of the accounting system.

- Preparing Financial Statements: Generating the key financial statements—income statement, statement of retained earnings, and balance sheet—to provide insights into the financial performance and position of a business.

Deconstructing the Problems: A Step-by-Step Guide to Mini Practice Set 1 Answers

The beauty of Mini Practice Set 1 lies in its progressive nature. Each problem builds upon the previous one, gradually introducing new concepts and reinforcing previous ones. Let’s break down the solution process in a clear and straightforward manner, making those once-daunting questions seem less intimidating.

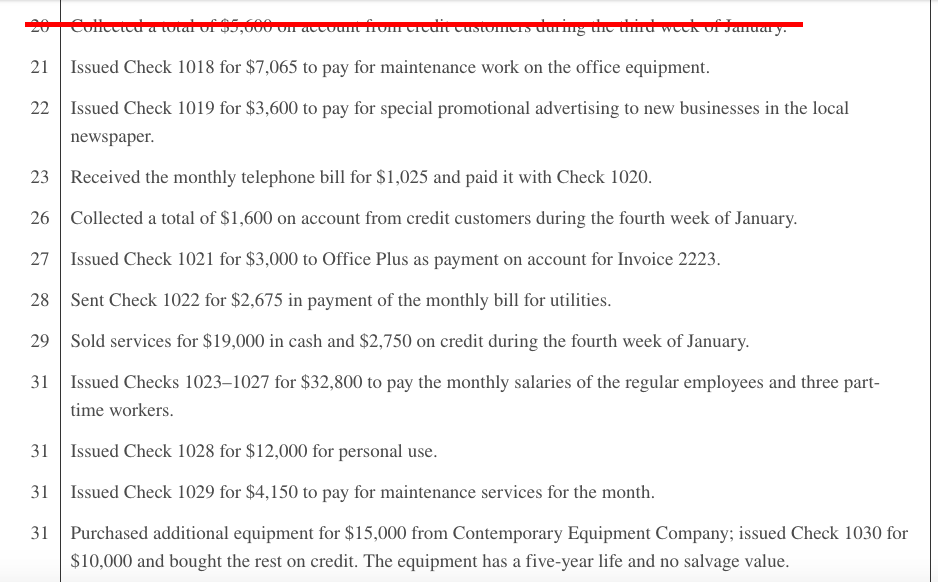

Problem 1: Journalizing Transactions

The first problem in the practice set focuses on the core of accounting—understanding how to record transactions. Here, you’ll be presented with a series of scenarios involving purchases, sales, payments, and receipts. The challenge is to correctly identify the accounts affected by each transaction and determine whether it results in a debit or credit.

This is where the fundamental accounting equation comes into play: Assets = Liabilities + Equity. Applying this equation will help you categorize each transaction. For instance, if a business purchases inventory on credit, it increases an asset (inventory) and a liability (accounts payable). Remember, assets are resources owned by the business, liabilities are obligations owed to others, and equity represents the owners’ stake in the business.

Using the T-account format, you’ll create a visual representation of the impact of each transaction on the involved accounts. If the transaction increases the account, you’ll add the amount to the debit side (left) of the T-account. If it decreases the account, you’ll add the amount to the credit side (right) of the T-account.

The key is to understand the nature of each account and its relationship to the accounting equation. For example, increases in assets are usually recorded as debits, while increases in liabilities and equity are recorded as credits.

Image: www.chegg.com

Problem 2: Posting to Ledgers

Once you’ve journalized the transactions, the next step is to transfer that information to the general ledger. This is where you’ll create a separate account for each item, summarizing all the activity related to that account.

Think of the general ledger as a collection of T-accounts, each representing a specific account. The process of posting involves transferring the debit and credit amounts from the journal to the respective ledger accounts. This helps you organize and track the financial activity for each account throughout a specific period.

To ensure accuracy, make sure that both the debit and credit sides of each T-account in the general ledger are added up to equal the total amount recorded in the journal entries.

Problem 3: Preparing the Trial Balance

The trial balance serves as a crucial checkpoint in the accounting process. It’s a list of all accounts in the general ledger along with their balances, organized in the format of a T-account.

The primary function of the trial balance is to ensure that the total of all debit balances equals the total of all credit balances. This fundamental principle of double-entry bookkeeping ensures that all transactions are recorded correctly and that no errors have been made.

If the totals on both sides are not equal, it suggests an error in the accounting process, requiring you to carefully review your journal entries and ledger postings to identify and correct the discrepancy.

Problem 4: Preparing Financial Statements

The final step in Mini Practice Set 1 involves utilizing the information gathered in the previous steps to prepare the financial statements, which are the key tools for communicating the financial performance and position of a business.

The three main financial statements are:

- Income Statement: Reports a company’s revenue and expenses over a specific period, resulting in either a profit or loss.

- Statement of Retained Earnings: Explains the changes in a company’s retained earnings (the accumulated profits that have not been distributed as dividends) during a period.

- Balance Sheet: Provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

To prepare these statements, you’ll need to gather data from the general ledger and apply the accounting equation to ensure that the components of each statement are correctly calculated.

Boosting Your Accounting Skills: Expert Advice and Tips

Mastering Mini Practice Set 1 is not just about getting the right answers; it’s about understanding the foundational concepts that will carry you through advanced accounting topics. Here are some key tips and insights to help you excel:

1. Visualize: Don’t just memorize the accounting rules. Visualize the transactions, imagine how they impact the balance sheet, income statement, and the overall financial picture.

2. Practice Regularly: Consistency is key. Don’t try to cram everything in one sitting. Work through Mini Practice Set 1 in manageable chunks, reviewing and refining your understanding as you go along.

3. Seek Help: Don’t hesitate to reach out for assistance when you encounter difficulties. Ask your instructor, classmates, or tutors for clarification. Don’t allow confusion to build; address it early and build a solid foundation.

FAQs: Common Questions About Mini Practice Set 1

Here are some answers to frequently asked questions about Mini Practice Set 1:

Q: What if I get an answer wrong?

A: Mistakes are part of the learning process. Don’t get discouraged if you don’t get everything right on the first try. Review the steps you took, analyze the correct answers, and try to understand the reasoning. The more you practice, the fewer mistakes you’ll make.

Q: Is it okay to use a calculator?

A: Absolutely! While it’s important to understand the underlying calculations, using a calculator can save you time and effort, allowing you to focus on the conceptual aspects of the problems.

Q: What are some resources available to help me with Mini Practice Set 1?

A: Your textbook, online resources like accounting tutorials and practice problems, and your instructor are great resources. Don’t be afraid to ask for clarification or additional practice.

Mini Practice Set 1 Accounting Answers

Conclusion: From Mini Practice Sets to Accounting Mastery

Mini Practice Set 1 is just the beginning of your accounting journey. By mastering these fundamental concepts, you’re building a strong foundation for future success. Remember, understanding the principles behind the numbers is what transforms you from a learner to an accountant—ready to tackle any challenge the financial world throws your way.

Are you interested in exploring other accounting practice sets or seeking deeper insights into financial concepts? Let us know in the comments below and we’ll delve into more advanced topics to help you navigate the exciting world of accounting!

![Cyclomancy – The Secret of Psychic Power Control [PDF] Cyclomancy – The Secret of Psychic Power Control [PDF]](https://i3.wp.com/i.ebayimg.com/images/g/2OEAAOSwxehiulu5/s-l1600.jpg?w=740&resize=740,414&ssl=1)