It’s a common misconception that once you close an account, it magically disappears from your credit report. But the reality is, those closed accounts can stick around, sometimes for years, potentially affecting your credit score. Imagine applying for a mortgage or car loan, only to have your application declined due to a closed account that shouldn’t even be there. This is a frustrating experience many people face, and it’s important to know your rights and understand how to handle such situations.

Image: www.dochub.com

In this article, we’ll equip you with the knowledge and tools to write a compelling letter requesting the removal of closed accounts from your credit report, helping you take control of your financial standing and pave the way for a brighter financial future.

Understanding Closed Accounts and Credit Reports

When you close an account, it doesn’t always mean it’s immediately removed from your credit report. Credit reporting agencies, like Experian, Equifax, and TransUnion, maintain records of your credit history, including closed accounts. These accounts can stay on your report for various periods, depending on the type of account and the credit bureau’s policies.

While closed accounts themselves don’t negatively impact your credit score, they can linger on your report and potentially affect your overall creditworthiness. For instance, if you have numerous closed accounts in collections or with negative payment history, it could raise red flags for lenders, making it harder to secure loans with favorable terms.

Why You Should Request Removal of Closed Accounts

There are several valid reasons why you might want to request the removal of closed accounts from your credit report:

- Improve your credit score: While closed accounts don’t necessarily hurt your credit score, removing them can positively influence it by increasing your average age of accounts and reducing the number of inquiries on your report.

- Simplify your credit history: A cluttered credit report with numerous closed accounts can make it difficult for lenders to assess your financial standing. Removing inactive accounts can streamline your report, making it easier for lenders to review and evaluate your creditworthiness.

- Protect yourself from identity theft: Closed accounts, especially those in collections, can be vulnerable to identity theft. By removing them from your credit report, you minimize the risk of someone using your information to open new credit lines or commit financial fraud.

- Improve your chances of getting approved for loans: Having fewer closed accounts on your report can make you appear more financially responsible to lenders, increasing your chances of approval for loans and credit cards with favorable terms.

How to Write an Effective Letter for Closed Account Removal

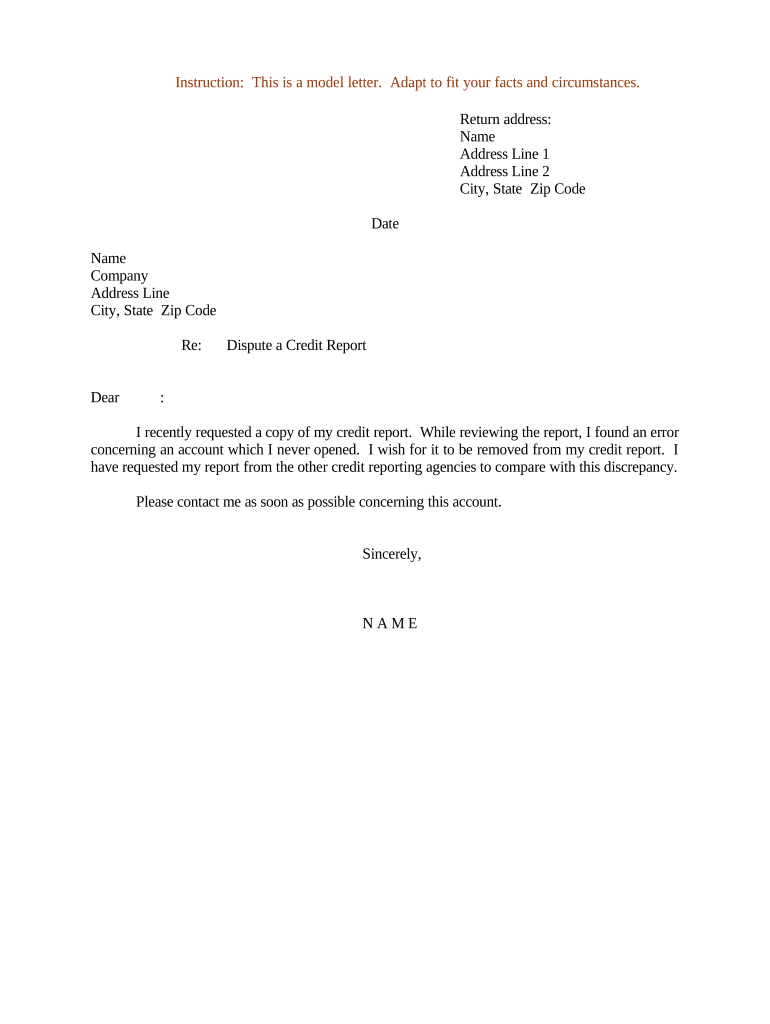

Now that you understand the importance of requesting closed account removal, let’s dive into the key steps for writing a persuasive letter:

- Gather your information: Before you start drafting your letter, carefully review your credit report and identify the closed accounts you want to remove. Make note of the following:

- Account type (credit card, loan, etc.)

- Account number

- Date the account was closed

- Credit bureau reporting the account

- Address the letter correctly: Ensure you address your letter to the appropriate credit reporting agency (Experian, Equifax, or TransUnion). Use a formal letter format and include your name, address, and phone number.

- State your request clearly: In the first paragraph, state your purpose for writing the letter, clearly requesting the removal of the specified closed accounts from your credit report. Include the account type, account number, and date the account was closed.

- Provide supporting documentation: Attach copies of any relevant documentation, such as a statement from the account holder confirming the account is closed or a letter from the creditor verifying the account’s closure. This strengthens your claim and demonstrates your diligence in resolving the issue.

- Explain your reasoning: In the subsequent paragraphs, explain why you believe the closed accounts should be removed. Highlight any inaccuracies or errors in the reporting, such as the account being inaccurately marked as being in collections or showing a balance when it’s already settled. Emphasize how these accounts affect your creditworthiness and hinder your ability to manage your financial well-being.

- Provide a timeline for action: State your request for a specific timeframe for the credit reporting agency to investigate your claim and remove the closed accounts from your report. This shows your intention to resolve the situation promptly and encourages action from the agency.

- Include contact information for follow-up: End your letter by reiterating your contact information, making it easy for the credit reporting agency to reach you with any questions or updates regarding your request.

Image: templates.udlvirtual.edu.pe

Tips for Writing a Successful Letter:

Here are some additional tips to ensure your letter is impactful and increases your chances of success:

- Be polite and respectful: Maintain a professional tone throughout your letter. While you’re requesting action, avoid using angry or accusatory language. Focus on clearly explaining your situation and your desire for a resolution.

- Keep it concise and straightforward: Avoid using lengthy, complex sentences. Get to the point quickly and ensure your message is clear and understandable.

- Proofread carefully: Before sending your letter, take the time to carefully proofread it for any grammatical or spelling errors. A well-written letter demonstrates your attention to detail and strengthens your communication.

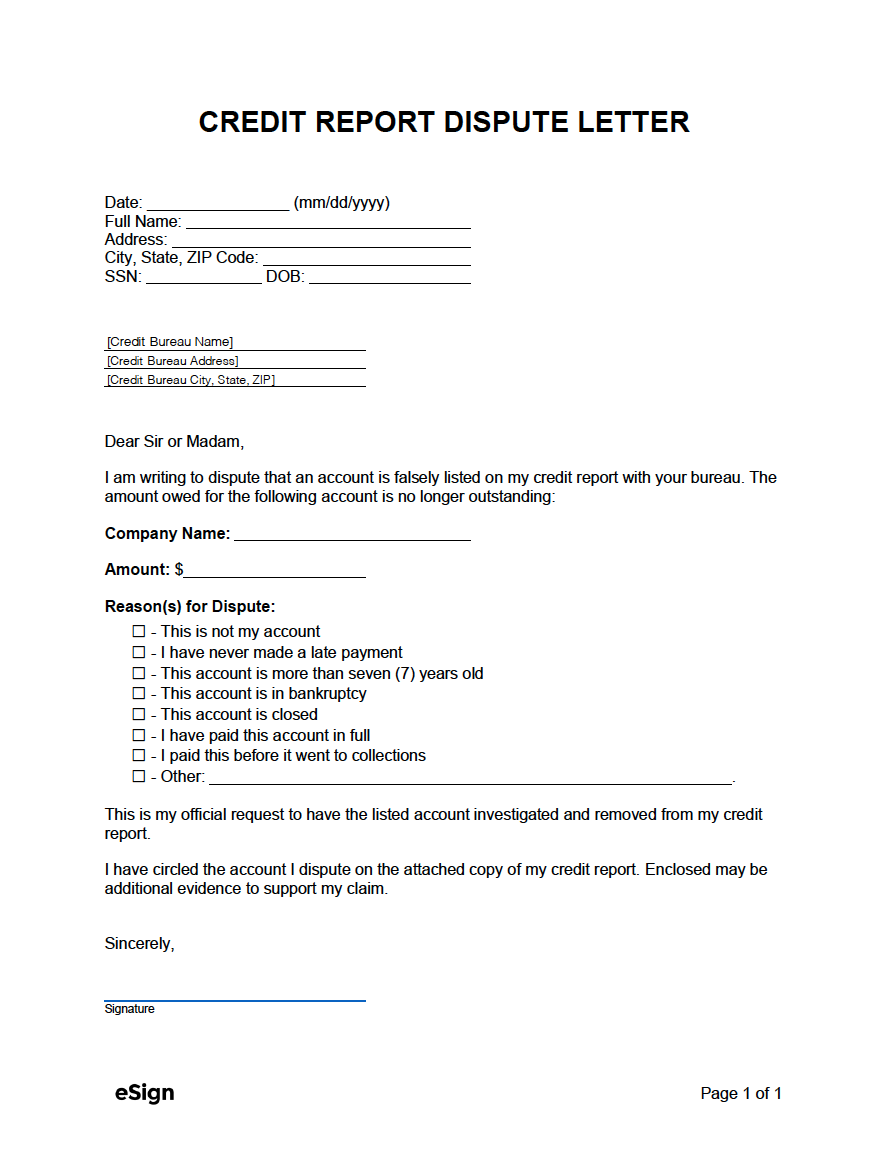

Sample Letter for Closed Account Removal:

Below is a sample letter you can use as a guide when writing your request:

[Your Name]

[Your Address]

[Your City, State, Zip Code]

[Your Phone Number]

[Your Email Address]

[Date]

[Credit Reporting Agency Name]

[Credit Reporting Agency Address]

[Credit Reporting Agency City, State, Zip Code]

Subject: Request to Remove Closed Accounts from Credit Report

Dear Credit Reporting Agency,

I am writing to request the removal of two closed accounts from my credit report. These accounts are:

- Account type: [Account type] – Account number: [Account Number] – Date closed: [Date]

- Account type: [Account type] – Account number: [Account Number] – Date closed: [Date]

These accounts have been closed for [period of time] and I believe their continued presence on my credit report is inaccurate and negatively affects my creditworthiness. I have attached a copy of [relevant documentation, such as a statement from the account holder or a letter from the creditor].

I kindly request that you investigate my request and remove these closed accounts from my credit report within [timeline for action]. Please contact me at [your phone number] or [your email address] if you have any questions or require further information.

Sincerely,

[Your Name]

Remember, this is just a sample, so modify it to match your specific situation.

FAQ:

Q1: What if the credit reporting agency refuses to remove the closed accounts?

If the credit reporting agency denies your request for removal, you have the right to dispute the information on your credit report. You can file a dispute with the credit reporting agency directly or contact the Consumer Financial Protection Bureau (CFPB) for assistance navigating the dispute process.

Q2: How long does it take for a credit reporting agency to process a dispute?

Credit reporting agencies are required to investigate your dispute within 30 days. They must then notify you of the outcome of their investigation and update your credit report accordingly.

Q3: Can I remove closed accounts myself without writing a letter?

You can directly contact the creditor who closed the account and request they inform the credit reporting agencies to remove the account from your report. However, writing a formal letter often expedites the process and provides a documented record of your request.

Sample Letter To Remove Closed Accounts From Credit Report

Conclusion:

Taking control of your credit report and ensuring its accuracy is crucial for securing your financial future. By understanding how closed accounts affect your creditworthiness and learning how to write a persuasive letter for their removal, you can streamline your financial journey. We urge you to get started today by reviewing your credit report, identifying potential issues, and taking action to protect your credit standing.

Are you ready to take charge of your credit? Share your thoughts and experiences with closed accounts and credit reporting in the comments below!

![Cyclomancy – The Secret of Psychic Power Control [PDF] Cyclomancy – The Secret of Psychic Power Control [PDF]](https://i3.wp.com/i.ebayimg.com/images/g/2OEAAOSwxehiulu5/s-l1600.jpg?w=740&resize=740,414&ssl=1)